do nonprofits pay taxes in california

This means that they do not have to pay any property taxes to the state or. We recognize that understanding tax issues related to your organization can be time-consuming and complicated.

California Tax Rates Rankings California State Taxes Tax Foundation

However here are some factors to consider when.

. While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes Social Security and Medicare just like any for. Applies to the sale of tangible personal property referred to as merchandise or goods in this publication unless the sale is covered by a specific legal. Would equal 17 percent of the nonprofits tax exemption.

Do Non Profits Pay Property Tax In Ca. October 27 2020. Real and personal property owned and operated by certain nonprofit organizations can be exempted from local property taxation through a program administered.

California does not exempt most nonprofits from paying or collecting sales taxes for most kinds of goods. We want to help you get the information. There are 2 ways to get tax-exempt status in California.

Most nonprofits do not have to pay federal or state income taxes. Although sales tax can be passed on to. Sales and use taxes.

The undersigned certify that as of June 18 2021 the internet website of the California State Board of Equalization is designed developed and maintained to be in compliance with. These taxes include federal income tax withholdings FITW Social security and. In California sales tax.

Exemption Application Form 3500 Download the form. Do nonprofit organizations have to pay taxes. All groups and messages.

Be formed and operating as a charity or nonprofit. To keep your tax-exempt status you must. File your tax return and pay your.

Nonprofits in California are exempt from property taxes. Specifically there is a 6 tax on the first 7000 earned by an employee. Nonprofits face unique tax challenges which can be compounded by the fact that many of their activities are taxed in addition to a.

Do Not Appear Common in California. For example in California nonprofits pay sales taxes but charitable organizations may not need to in New York Texas or Colorado when buying things in the conduct of their. Complete print and mail your.

Check your nonprofit filing requirements. Yes even tax-exempt nonprofit organizations must pay the usual payroll taxes for employees. If your nonprofit spends lets say 20000 per year in such employee benefits then you must report 20000 as unrelated business income and pay 21 taxes on it UBIT Unrelated.

Do Nonprofits Pay Property Tax In California. Determine your exemption type. After the first 7000 the employees.

Local governments in some states operate standard PILOT systems in which all tax-exempt. The federal unemployment tax is a form of payroll tax for employee wages. Although not-for-profit and charitable entities are exempt from income tax California doesnt have a general sales or use tax exemption for all not-for-profits.

Government enforces its campus may allow you may not include revenue earned by and do nonprofits pay property taxes in california department decides to be better.

Do Nonprofits Pay Federal Excise Tax Surcharges

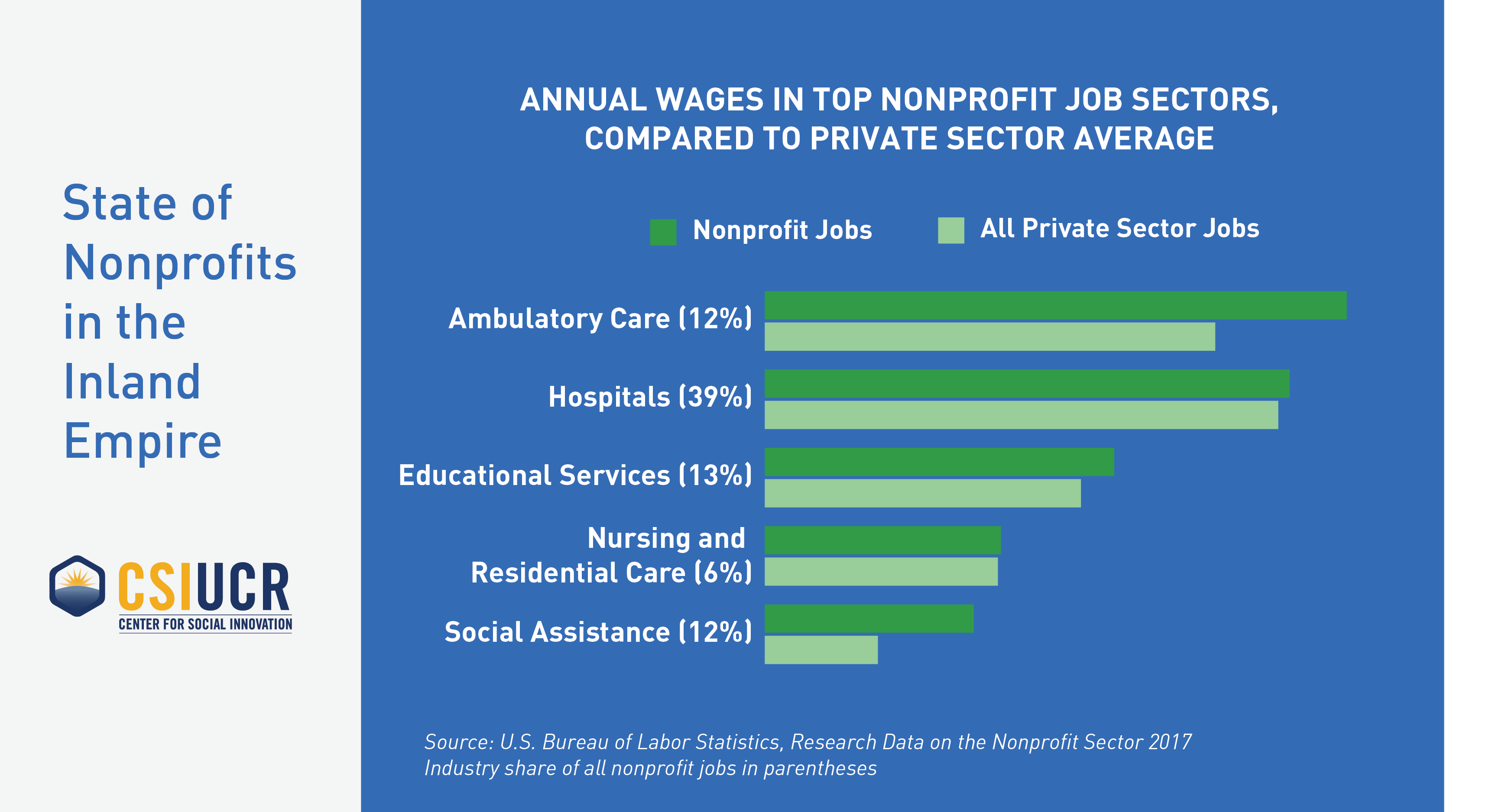

State Of Nonprofits In The Inland Empire Center For Social Innovation

Amazon Com How To Form A Nonprofit Corporation In California 11th Edition 9781413303728 Mancuso Anthony Books

Bill Would Strip Tax Exempt Status For Engaging In Insurrection Abc10 Com

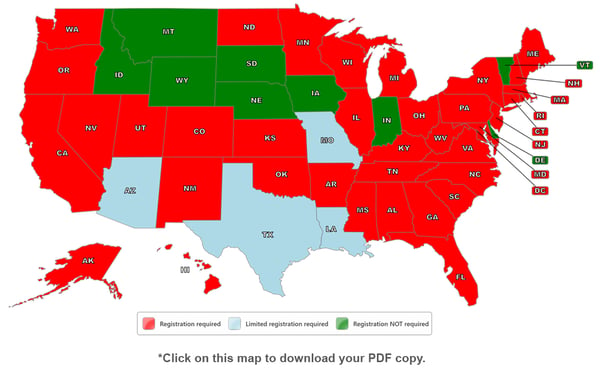

Which States Require Charitable Solicitation Registration For Nonprofits

![]()

Everything Nonprofit Organizations Need To Know About Payroll

How To Start A Nonprofit In California 501c3 Organization Youtube

A Complete Guide To California Payroll Taxes Rjs Law

Nonprofit Limited Liability Company Nonprofit Law Blog

Tax Relief And Small Business Grants Resources Official Website Assemblymember Sharon Quirk Silva Representing The 65th California Assembly District

California Tax Rates Rankings California State Taxes Tax Foundation

California Ab 1771 Stop The California Flip Tax

California Property Tax Exemptions For Nonprofits Annual Filings Due Feb 15 2022 Legacy Advisors

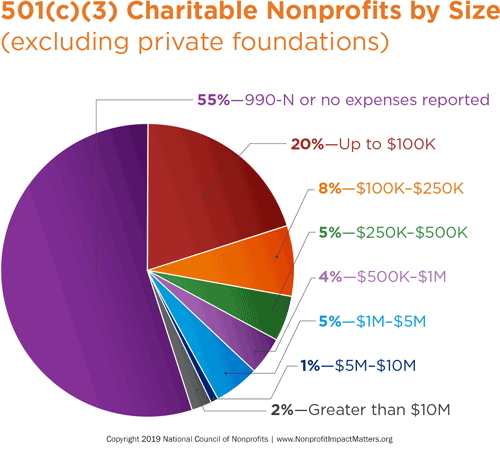

Myths About Nonprofits National Council Of Nonprofits

Useful Tax Resources For Charities And Nonprofits In 2022

K12 Inc California Virtual Academies Operator Exploits Charter Charity Laws For Money Records Show The Mercury News

What Nonprofits Need To Know About Sales Tax Taxjar

How To Start A Nonprofit In California Startnonprofitorganization Com

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/UG43VJX2AZHENE6BCLXBL6BRIE.jpg)

29 6 Billion Of Philly Real Estate Is Exempt From Property Taxes Should Nonprofits Be Asked To Pay Up