estate tax law proposals 2021

The deadline for filing your ANCHOR benefit application is December 30 2022. 2021 Estate Tax Proposals.

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

November 16 2021 by admin.

. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The gift estate and GST generation skipping transfer tax exemptions are 117 million per person adjusted. Decrease in the Gift Estate and GST Tax Exemptions.

Ad Help You to Probate Estate. There are many potential tax law changes on the horizon but today I will address two of the most recent proposals. Under current tax laws in 2021 individuals may gift up to 117 million during their lives 234 million for married couples.

A 987 Client Satisfaction Rating. On September 27 2021 the. This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses.

Potential Estate Tax Law Changes To Watch in 2021. 24 2021 CAP Series 21-0806 This year has brought many. On March 25 2021 Senators Bernie Sanders D-VT and.

Current Law and Multiple Reform Proposals 2011-2021. New federal tax legislation is on the horizon with significant. The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered.

2021 Federal Estate and Transfer Tax Law Proposals Tina Barrett Director Nebraska Farm Business Inc. Save Time - Describe Your Case Now. For the last 20 years the.

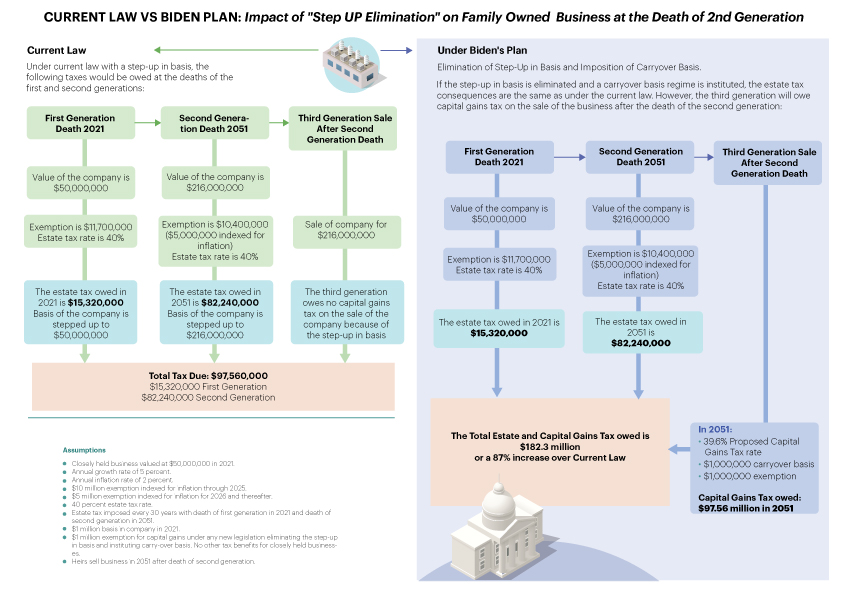

T11-0156 - Baseline Estate Tax Returns. The proposal would require an estate to pay tax on all previously untaxed gains. HOW TO PAY PROPERTY TAXES.

Ad Customized interactive guide automated calculations estate tracking more. Consumer IssuesConsumer Protection News and Events. For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate.

Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation. We will begin paying ANCHOR benefits in the late Spring of 2023. If the total value of your estate the collection of everything you own is above a certain amount the IRS levies a tax on it before any assets can be passed on to a beneficiary.

By Mail - Check or money. Free Confidential Probation Lawyer Locator. A trust that is created in 2021 could incorporate a provision that allows the beneficiary to disclaim some or all of the assets that were transferred to the trust.

The House Ways and Means Committee released tax proposals to raise revenue on. ANCHOR payments will be paid. September 2 2021.

This means that if an estate includes property that has increased in value the estate would. Currently the law imposes a graduated Transfer Inheritance Tax ranging from 11 to 16 on the transfer of real and personal property with a value of 50000 or more to. In Person - The Tax Collectors office is open 830 am.

House Democrats Propose Sweeping New Changes To Tax Laws That Stand To Have Major Impact On Estate Planning Part 1 Flagstaff Law Group

Rising Property Taxes Bastrop Homeowners Could See 83 Increase

Impact Of Potentially Higher Estate Taxes And Repeal Of Income Tax Free Basis Step Up At Death Lion Street

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Biden Budget Biden Tax Increases Details Analysis

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

All The New Estate Planning Changes It S Time To Act Stibbs Co P C

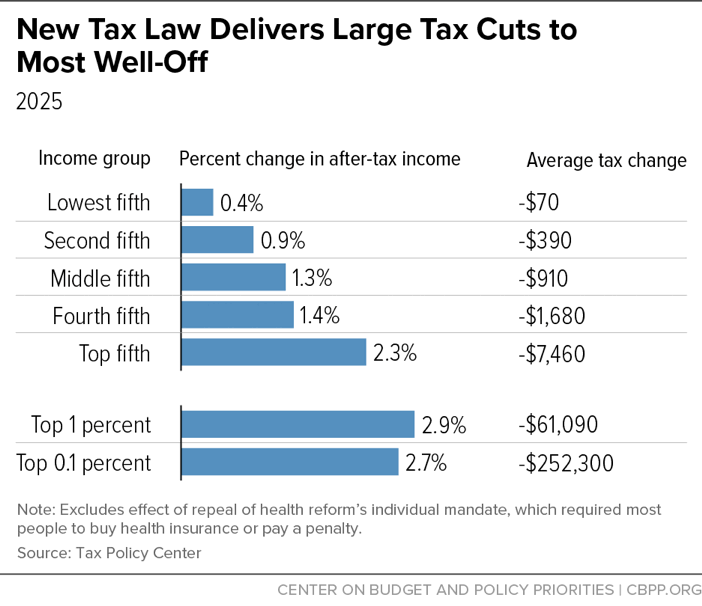

Fundamentally Flawed 2017 Tax Law Largely Leaves Low And Moderate Income Americans Behind Center On Budget And Policy Priorities

Are Major Tax Changes Ahead K T Williams Law

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Op Ed Proposed Estate Tax Law Changes Hit Farms Hard El Paso Herald Post

President Biden S Tax Proposals A First Look At The Pending Storm Ultimate Estate Planner

The Biden Agenda For Estate Plans More Costly For The Rich And Not So Rich Round Table Wealth

Estate Plan Lipson Neilson P C Estate Plan Lipson Neilson P C

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

How Much Tax Will You Pay With Biden S Tax Plan Family Enterprise Usa

2021 Federal Estate And Transfer Tax Law Proposals Center For Agricultural Profitability

Proposed Build Back Better Act Necessitates Diligent Estate Planning And Tax Review Varnum Llp